|

Unknown |

|

at 10:54 AM |

|

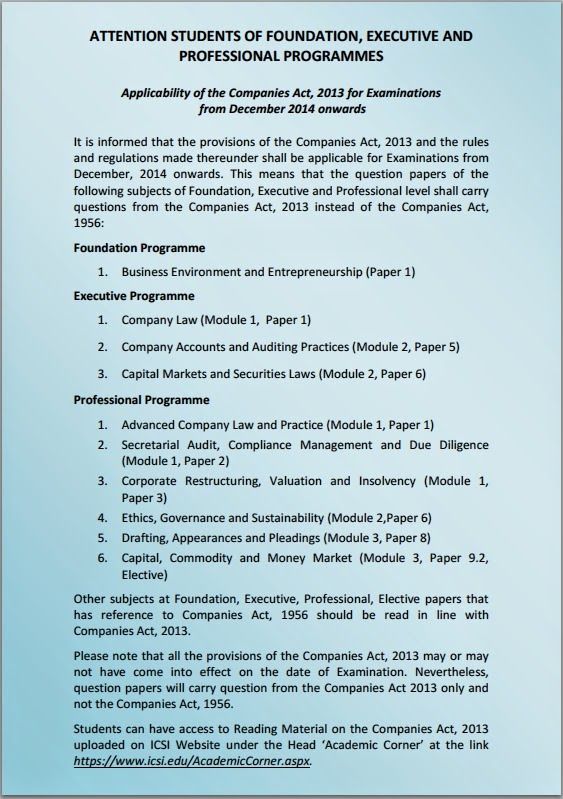

2014 Companies Act 2013 CS Executive CS Professional ICSI Updates |

|

Unknown |

|

at 10:26 AM |

|

2013 CA Final Companies Act Corporate Law Updates |

Punishment for failure to distribute dividends under Companies Act, 2013 in light of provisions under the erstwhile Act

Retention by company of dividend beyond 30 days from the date its distribution is due attracted punishment under Sec. 207 of the erstwhile Companies Act,1956;

MCA notified 98 Sections of the Companies Act, 2013 on 12th September,2013 which came into force with immediate effect.

These notified sections included Sec. 127 also which has replaced Sec 207 of the erstwhile act and deals with punishment for failure to distribute dividends. It is worthwhile to mention here that “Dividend” includes Interim Dividend also(as was also the case in erstwhile act).

Though largely the spirit of the current provisions are in line to previous act’s provisions, here are some significant differences :

- Earlier the Director(s) if found to be knowingly a party to the default, were liable for imprisonment extending up to 3 years, this tenure of imprisonment has been reduced to 2 years under Sec 127 of CA,2013

- In sec. 207 of the companies act, 1956, in the “exceptions under which no offence was deemed to have been committed” was included the following situation :

where a shareholder has given directions to the company regarding the payment of the dividend and those directions cannot be complied with;

In Sec. 127 of the Companies Act,2013; the exceptions part includes the following :

where a shareholder has given directions to the company regarding the payment of the dividend and those directions cannot be complied with & THE SAME HAS BEEN COMMUNICATED TO HIM;

Hence, We can clearly identify that the words “& THE SAME HAS BEEN COMMUNICATED TO HIM” have been appended to the text of previous provision. The gravity of this addition is that now, if the directions given by the shareholder can’t be complied with and this is the reason why there will be a delay beyond 30 days to distribute dividend with respect to his shares, this fact will have to be communicated to him to avoid the punishment. The earlier fiction that provided that if the directions can’t be complied with, no offence shall be deemed to have been committed has been done away with now, a communication of such facts is now mandatory.

- Companies Act, 2013 expressly permits electronic payment for dividends

For the ease of reference, the current provisions u/s 127 of the Companies Act, 2013 are produced below:

Where a dividend has been declared by a company but has not been paid or the

warrant in respect thereof has not been posted within thirty days from the date of declaration

to any shareholder entitled to the payment of the dividend, every director of the company

shall, if he is knowingly a party to the default, be punishable with imprisonment which may

extend to two years and with fine which shall not be less than one thousand rupees for every

day during which such default continues and the company shall be liable to pay simple

interest at the rate of eighteen per cent. per annum during the period for which such default

continues:

Provided that no offence under this section shall be deemed to have been

committed:—

(a) where the dividend could not be paid by reason of the operation of any law;

(b) where a shareholder has given directions to the company regarding the

payment of the dividend and those directions cannot be complied with and the same

has been communicated to him;

(c) where there is a dispute regarding the right to receive the dividend;

(d) where the dividend has been lawfully adjusted by the company against any

sum due to it from the shareholder; or

(e) where, for any other reason, the failure to pay the dividend or to post the

warrant within the period under this section was not due to any default on the part of

the company.